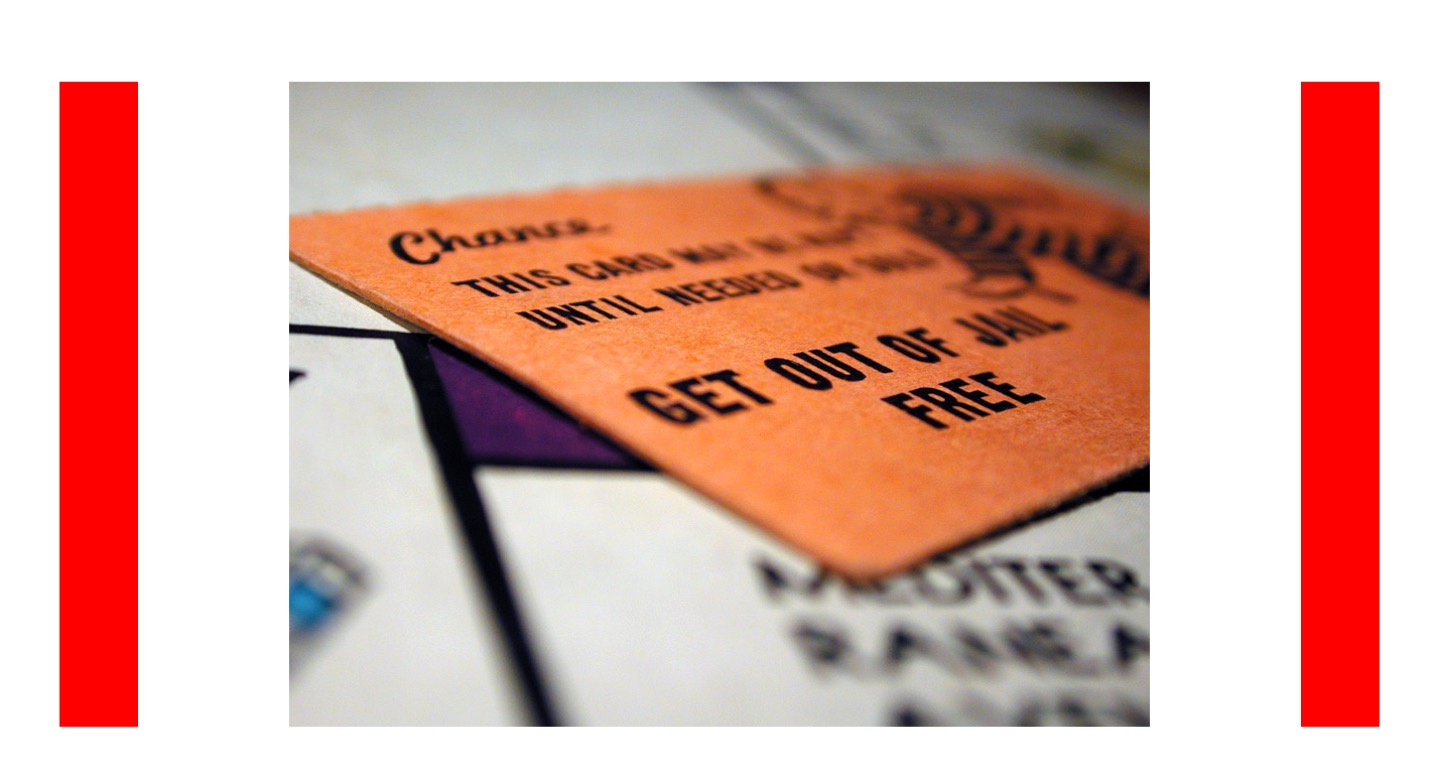

It is tempting for CEOs to try to appease their shareholders by reducing corporate overhead costs. It seems to be the corporate equivalent of a ‘Get Out of Jail Free card’ in Monopoly: it is free and can get a CEO out of a tricky situation.

The reason is that everyone loves the notion of lowering corporate overhead costs, and especially reducing the number of people in corporate roles.

Whereas the supervisory board occasionally might call for caution, you will never hear shareholders or analysts complain and Business Unit leaders usually love the perspective of lower corporate charges and more independence. Most often, corporate functions cannot count on a lot of sympathy from the rest of the workforce either. They are seen as overpaid ‘bureaucrats’, ‘paper pushers’, and ‘PowerPoint wizards’ in ‘back-office’ roles.

Reducing overhead is also not very difficult. Usually, there are plenty of young runners-up in large organizations dying to prove themselves to corporate leaders. If not, consulting firms are happy to line up for beauty parades to show off their capabilities in this area.

It is also not that hard – at least, I have never seen a corporate cost savings initiative not achieving its short-term financial objectives.

So eliminating or reducing these corporate functions is a great idea, right?

Unfortunately, it depends…

Eliminating or reducing corporate functions poses risks for CEOs in three areas:

- Compliance

- Shareholder activism

- Boardroom dynamics