‘You need to provide recyclable note paper to demonstrate the commitment of our company to sustainability’, I was told when I co-organized a meeting where the vast majority of participants arrived by airplane, most of them on intercontinental flights…

I have always been quite cynical about ESG (Environmental, Social, and Governance) and CSR (Corporate Social Responsibility) initiatives from public companies.

Some of my favorite examples include:

- A “Big Oil” company using the “greenness” of suppliers as a selection criterion in the purchasing process

- A Financial Services company that directly contributed to the Euro crisis but gave its employees an afternoon off to paint schools in derelict areas to “give back to society”

- ESG leaders flying en masse to conferences in New York to discuss how to make the world a more sustainable place

- Companies that started “recalibrating” their DEI efforts in the aftermath of the last US presidential election.

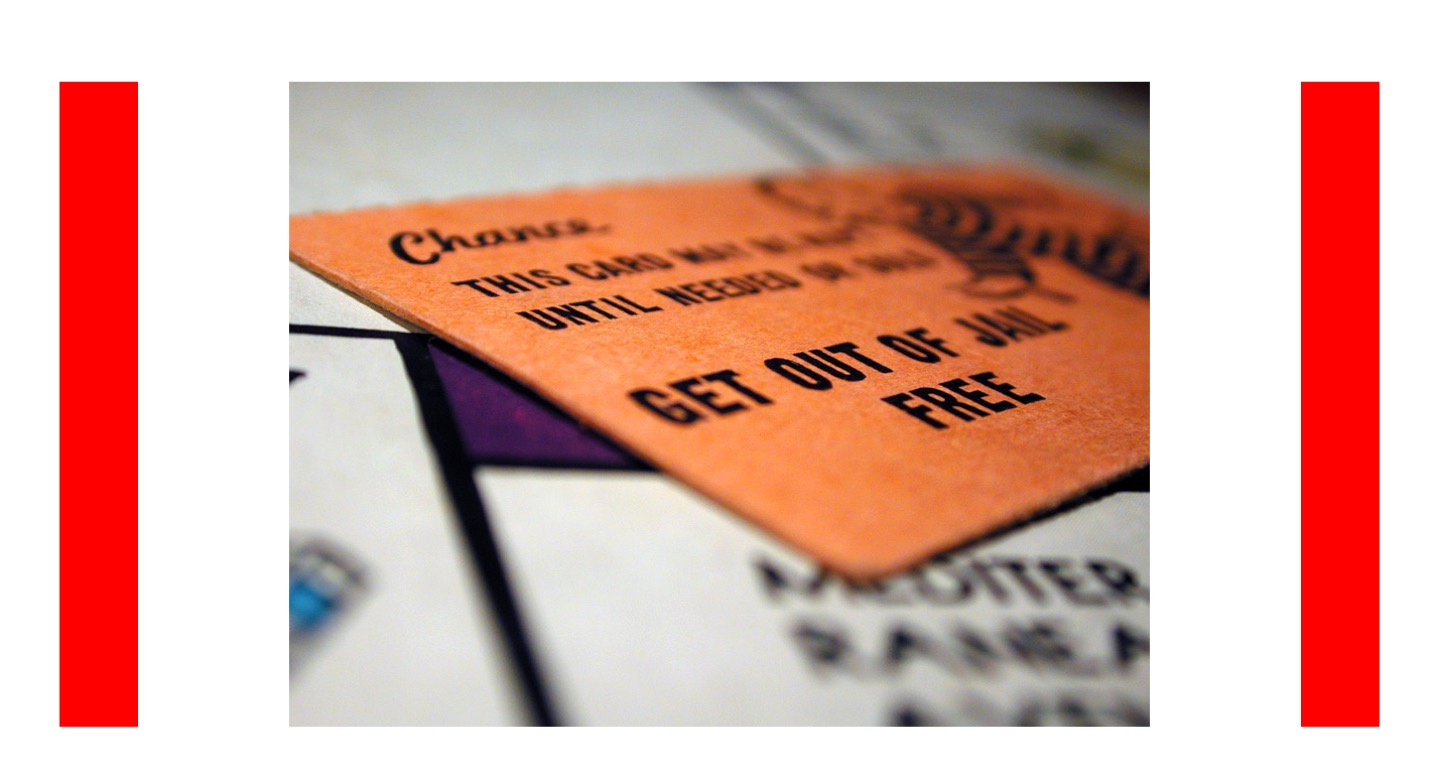

The behavior of most pubic companies in the ESG and CSR space always strikes me as ‘Do as I say, not what I do’. Not because the leaders of these companies are inherently ‘evil’ or ‘immoral’, but simply because, when push comes to shove (most often under pressure from their supervisory boards, or activist shareholders), they do not seem to have an alternative but to let Shareholder Value prevail in their decision-making process.

‘People, Planet, and Profit. But the greatest of these is Profit…’

🎙️ ‘A big conversation with big questions’, that is how Sander Tideman characterized the conversation I had with him about ESG and CSR.

Sander is a researcher, author, entrepreneur and executive coach in sustainable leadership. He works with leaders to build flourishing organizations equipped to address the unprecedented challenges of today. He has worked for and consulted with leading organizations on three continents, and is publicly known for his work with top leaders in, for instance, Unilever.

In the 31th episode of the Leadership 2.0 podcast, I interview Sander about the question if and how pubic companies and our society should adopt ESG and CSR concepts.

During our conversation, we discussed the following topics: